Small businesses often face cash flow challenges due to the delay between invoicing clients and receiving payments. These gaps can make it difficult to manage operations, pay suppliers, and expand. Invoice financing provides a solution to this challenge, offering small businesses a way to access cash tied up in unpaid invoices. In this article, we will explore the concept of invoice financing, how it works, its benefits, and potential drawbacks.

What is Invoice Financing?

Invoice financing is a financial solution that allows businesses to borrow money based on the amounts due from customers in unpaid invoices. Instead of waiting for customers to pay their invoices, companies can receive immediate funds from lenders, which helps improve their cash flow.

Invoice financing is not a loan but a form of asset-based lending, where the unpaid invoices act as collateral. This form of financing allows businesses to bridge the gap between the time they issue invoices and the time they actually receive payment.

Types of Invoice Financing

There are several types of invoice financing that businesses can utilize depending on their needs:

- Invoice Factoring: In invoice factoring, a business sells its unpaid invoices to a financing company (factor) at a discounted rate. The factor collects payment from the customers directly and remits the remaining balance after taking a fee.

- Invoice Discounting: In this method, the business retains control over its sales ledger and customer relationships. Instead of selling the invoices, the business borrows money against its unpaid invoices and repays the financing company once customers pay their invoices.

- Selective Invoice Financing: With selective invoice financing, businesses can choose which invoices they want to use for financing, offering more flexibility.

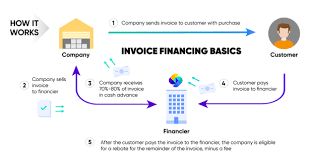

How Does Invoice Financing Work?

Invoice financing is a relatively simple process. It usually follows these basic steps:

- Issue an Invoice: The business sells goods or services to a customer and issues an invoice with a payment term (e.g., 30, 60, or 90 days).

- Apply for Financing: The business applies for financing with a lender or factoring company by submitting unpaid invoices.

- Approval and Cash Advance: The lender evaluates the invoices and, if approved, advances a percentage of the invoice value to the business. This percentage typically ranges from 70% to 90%.

- Customer Payment: Once the customer pays the invoice, the lender deducts its fees and sends the remaining balance to the business.

Example of Invoice Financing

Suppose a small business issues an invoice for $10,000 with a payment term of 30 days. The business decides to use invoice factoring. The factoring company agrees to advance 85% of the invoice value, which amounts to $8,500. The factoring company then collects payment from the customer. Once the customer pays the full invoice, the factoring company deducts a fee (e.g., 2%), and the business receives the remaining $1,500.

Benefits of Invoice Financing

Invoice financing offers several advantages that can benefit small businesses, especially those facing cash flow challenges.

Improved Cash Flow

The primary benefit of invoice financing is improved cash flow. By accessing cash tied up in unpaid invoices, businesses can cover immediate expenses such as payroll, suppliers, and operating costs without waiting for clients to settle their accounts.

Quick Access to Funds

Invoice financing provides faster access to funds compared to traditional loans, which may take weeks to process. Small businesses can receive funds in as little as 24 to 48 hours after approval, helping them address short-term financial needs.

Flexible Financing

This type of financing is flexible and scalable. As a business grows and generates more invoices, it can access more funds. Additionally, with selective invoice financing, businesses can choose which invoices to finance, giving them more control over their cash flow.

No Need for Collateral

Unlike traditional loans that require assets such as property or equipment as collateral, invoice financing uses the unpaid invoices themselves as collateral. This makes it an attractive option for businesses without significant assets.

Reduced Collection Burden

In the case of invoice factoring, the financing company takes over the responsibility of collecting payments from customers. This allows businesses to focus on core operations instead of spending time and resources on debt collection.

Drawbacks of Invoice Financing

While invoice financing has many benefits, it is important to understand the potential drawbacks.

Cost

One of the main disadvantages of invoice financing is the cost. Lenders charge fees that can range from 1% to 5% of the invoice value, which can add up over time. These fees can reduce profit margins, particularly for businesses with low-profit invoices.

Impact on Customer Relationships

In invoice factoring, the financing company deals directly with the business’s customers to collect payments. This can potentially harm customer relationships if the factoring company is aggressive in its collection efforts or if customers are uncomfortable with the arrangement.

Credit Risk

Invoice financing providers often assess the creditworthiness of the business’s customers, not just the business itself. If a company’s customers have poor payment histories, it may limit the amount of financing available or result in higher fees.

Limited Control

With invoice factoring, businesses may lose some control over their invoicing process since the factoring company handles collections. This can lead to complications, particularly if the business has a complex relationship with its customers.

When Should Small Businesses Use Invoice Financing?

Invoice financing is ideal for businesses that face cash flow challenges but have significant amounts of outstanding invoices. It works particularly well for industries with long payment terms, such as manufacturing, construction, and wholesale, where businesses may have to wait 60 to 90 days to receive payment.

Businesses experiencing rapid growth may also benefit from invoice financing as it provides immediate cash to meet increased demand without the need for long-term loans or equity investment.

Key Considerations Before Choosing Invoice Financing

Before opting for invoice financing, small businesses should consider the following:

- Customer Payment History: Invoice financing works best when customers have a good payment history. If customers frequently delay payments, it could affect the business’s ability to secure financing.

- Financing Costs: Businesses should carefully compare fees and charges from different providers to ensure that the cost of financing doesn’t erode their profit margins.

- Customer Relationships: In cases of invoice factoring, businesses should consider how their customers may react to dealing with a third party for payments.

How to Choose an Invoice Financing Provider

Choosing the right invoice financing provider is crucial for the success of the financing arrangement. Here are some tips to help businesses select the best option:

Research the Provider

Look for reputable and experienced providers that specialize in invoice financing for small businesses. Check online reviews, ask for references, and research their industry expertise.

Compare Fees and Terms

Compare the fees, terms, and conditions of different providers. Look for transparency in fee structures and ensure that there are no hidden charges. Understand whether the provider offers recourse or non-recourse financing (which determines who is responsible for unpaid invoices).

Check Customer Service

Since invoice financing involves customer interactions, it’s important to choose a provider with excellent customer service. This ensures that any issues related to collections or customer communication are handled professionally and promptly.

Assess the Application Process

Look for providers with a simple and efficient application process. Some providers offer online platforms that allow businesses to track invoices and manage their financing in real-time.

Conclusion

Invoice financing is a valuable tool for small businesses looking to improve their cash flow without taking on traditional debt. It allows businesses to convert unpaid invoices into working capital, providing immediate access to cash for day-to-day operations. However, it’s essential to carefully evaluate the cost, impact on customer relationships, and terms of the financing arrangement before making a decision.

By understanding the types of invoice financing and choosing the right provider, small businesses can benefit from greater financial flexibility, allowing them to grow and succeed in today’s competitive environment.

Frequently Asked Questions

What is invoice financing?

Invoice financing is a form of funding where businesses use their unpaid invoices as collateral to secure immediate cash. Instead of waiting for customers to pay their invoices, businesses receive an advance from a lender based on the value of these invoices.

How does invoice financing benefit small businesses?

Invoice financing helps small businesses manage cash flow by providing immediate funds from outstanding invoices. This allows businesses to pay for expenses such as payroll, supplies, and rent without waiting for their customers to pay.

What is the difference between invoice factoring and invoice discounting?

In invoice factoring, a business sells its invoices to a lender, who then collects payments directly from customers. In invoice discounting, the business retains control of its sales ledger and customer relationships, borrowing against the value of the unpaid invoices.

How much does invoice financing cost?

The cost of invoice financing varies depending on the lender and the type of financing. Typically, fees range from 1% to 5% of the invoice value. These fees can include service charges, interest, and other costs.

Are there any risks involved with invoice financing?

Yes, there are risks. Invoice financing can be costly, and in the case of factoring, businesses may lose some control over their customer relationships. Additionally, if customers fail to pay, the business could be responsible for the unpaid debt, depending on the financing agreement.

How long does it take to receive funds through invoice financing?

In most cases, businesses can receive funds within 24 to 48 hours after submitting their invoices and being approved for financing. The speed of funding is one of the main advantages of invoice financing.

Can all types of invoices be financed?

Not all invoices qualify for financing. Most lenders require that the invoices be issued to creditworthy customers with a history of timely payments. Invoices that are disputed or have extended payment terms may not be eligible.

How do I choose the right invoice financing provider?

When choosing a provider, research their reputation, fees, terms, and customer service. Look for transparency in their pricing and ensure they have experience working with businesses in your industry. Consider reading reviews or asking for recommendations.